Portfolio update – April 2024

How to achieve financial freedom?It’s easy to say. It’s harder to achieve. For the future me is this journal entry. Starting from the year 2021, I describe the long way, point out the successes and the wrong decisions that I have made. I hope it will also motivate you to build your financial independence.

Summary

April is the month when many companies publish their financial results. Mintos and major lenders in Esketit and Peerberry shared their reports.

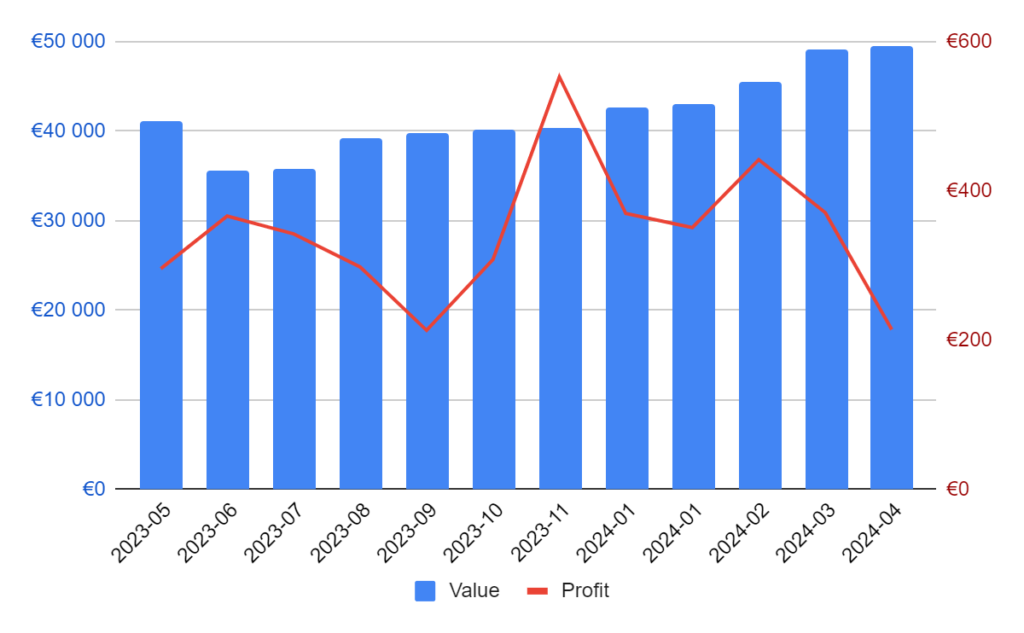

The chart below was strongly dragged down by ETFs result. I’m wondering whether to exclude this position from the summary. The instability of the stock exchange position significantly distorts the picture of profits, even though it does not significantly affect the portfolio value.

But for now, please check out the update:

Portfolio history (last 12 months)

Portfolio summary

| Position | Value | Profit |

|---|---|---|

| Bitfinex Lending | €10 934 | €26 |

| Mintos (EUR) | €13 960 | €123 |

| Mintos (RUB) | €2 732 | €0 |

| Robocash | €11 516 | €91 |

| Esketit | €4 400 | €34 |

| PeerBerry | €3 033 | €25 |

| ETF | €2 984 | -€85** |

| Total | €49 558 | €214 |

Bitfinex Lending*

The demand for loans is still in a decreasing trend. Loans, even if granted, are repaid before the due date (sometimes even in a few hours). Position in the portfolio for further observation, in case of longer stagnation I plan to reduce my involvement on the platform.

Graph of all loans last month:

Mintos (Euro €)*

Runda finansowania dla Mintos została zamknięta wynikiem prawie 3.2 miliona euro. Warto dodać, że wynik jest prawie dwa razy mniejszy niż poprzednia runda w 2020 roku oraz trzy razy większy niż zysk w 2023 roku (wyniki finansowe poniżej). Wydaje mi się, że oczekiwania z rundy Mintos mógł mieć większe niż 3 krotność rocznego zysku.

The financing round for Mintos closed with almost EUR 3.2 million. The result is almost twice less than the previous round in 2020 and three times more than the profit in 2023 (financial results below). I think expectations from the Mintos round could have been higher than 3 times of the annual profit.

Other news:

- Financial results 2023 – Mintos increased revenues by EUR 3 million, profits alone doubled to over EUR 1 million. Interestingly, most of this result was made up by penalties against companies in default. Without these additional penalties, the platform would not have managed to break even.

- Przy okazji finansowania społecznościowego Mintos ogłosił dwa nowe produkty, które planuje wprowadzić w najbliższym czasie: “Passive Rental Real Estate” oraz “Mintos Smart Cash”. Co w nich będzie, tego jeszcze nie wiadomo, ale nazwa mówi sama za siebie.

- On the crowdfunding updates, Mintos announced two new products. They have a plans to introduce them in the near future: “Passive Rental Real Estate” and “Mintos Smart Cash”. It is not yet known what they will contain, but the name speaks for itself.

Let’s get back to the month summary, no major changes. There is an increase in outstanding loans, but I am used to such values 😉

If you want to start your adventure with Mintos platform, please check out my review: Mintos Review (2024): 14.89% return after 3+ years

Mintos (Rubel rosyjski ₽)*

As a reminder, the position has been pending since the war in Ukraine. Currently, there is the last company left to repay – Kviku.

News from the ruble position, unfortunately it does not apply to my part. Mintos managed to sell the debts to the lender Dozarplati and they will finalize it at 50-75% repayment. The value of their portfolio is over EUR 5 million. For comparison, the value of Kvik’s portfolio is over €40m.

This news gives me hope that the time will come for Kviku soon 🙂

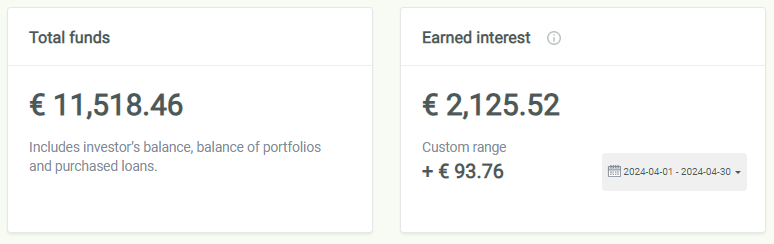

Robocash*

Pleasant boredom in the Robocash position. They managed to repay the outstanding loans to zero. Unfortunately, the return on ROI is dangerously close to the 10% mark. However, this is still a higher rate than offered on savings accounts.

If you don’t know how to start your adventure with Robocash. Feel free to check review and detailed description of my strategy: Robocash Review (2024): 12.65% return after 2 years

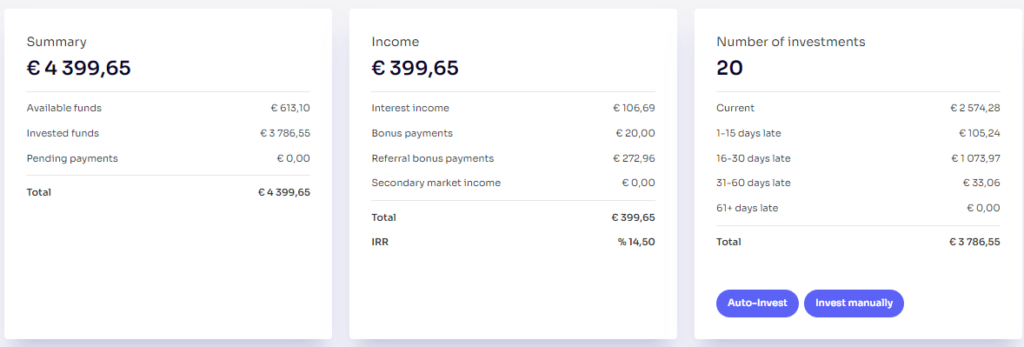

Esketit*

One of the larger lenders on Esketit, Jordanian Money for Finance, presented a financial report. The results look very good: revenues have almost doubled and profits have tripled.

Unfortunately, there is also sad news, at the end of April, new loans on the Jordanian market will have an interest rate of 11% (1% lower). Taking into account the current situation in the region and the interest rates of other companies on the platform, I decided to exclude loans from this company from my automatic strategy. Unfortunately, for now the risk has outweighed the expected return.

Let’s get back to the result itself, after the previous month ended with a 16% return, this month ended with a profit without any surprises – at the level of 10%. Overdue loans look alarming. For now, I observe the behavior of lenders in such a situation. Hoping that, just like in Mintos, they will end with an extra return resulting from the higher interest rate for the delay period.

PeerBerry*

A fresh item in the investment basket. The platform’s main lender, Aventus Group, has published its results. The group’s profit is over EUR 50 million, which is almost four times more than a year ago. Such results are pleasing because they build the security of the platform and guarantee the repayment of delayed loans.

The result itself currently oscillates around 10%, with a slight increase in outstanding loans. Nothing to worry about.

ETF

The ETF rally has finally stopped. There have been increases month by month for the last 6 months. The change is not big, so it is not particularly worrying. On the other hand, in the event of a large decline, it would be worth investing in the position. For observation.

(*) I play open cards. Links marked with an asterisk are affiliate links. If you use them, I will receive a commission. It won’t cost you anything, and often you will get a bonus too – More information can be found on the pages under the specific links.

(**) Due to the nature of the stock market, income should be understood as potential until the position is realized.