Portfolio update – March 2025

How to achieve financial freedom?It’s easy to say. It’s harder to achieve. For the future me is this journal entry. Starting from the year 2021, I describe the long way, point out the successes and the wrong decisions that I have made. I hope it will also motivate you to build your financial independence.

Summary

At the beginning of April, as I write this, the stock market is having a heart attack, but it is recovering efficiently; for a few days, prices were in the red, only to rise again by a dozen or so per cent. One thing is for sure, the next few months will not be boring.

I am curious about the impact of trade and political turmoil on the P2P lending market. My intuition tells me that the impact should be minimal, but I know that emotions play a role. During crises, there is an outflow of money into ‘safe’ assets, which can put pressure on higher interest rates offered on lending platforms.

In March, similar to the previous month, I added another 5000 EUR to my portfolio. The increase related to two positions:

- Mintos: 1000 euros.

- PeerBerry: 4000 euros. I am increasing my wallet to reach the next loyalty bonus threshold.

I still have a new platform in store, which I will keep secret for a few months for the testing period.

I invite you to a detailed analysis.

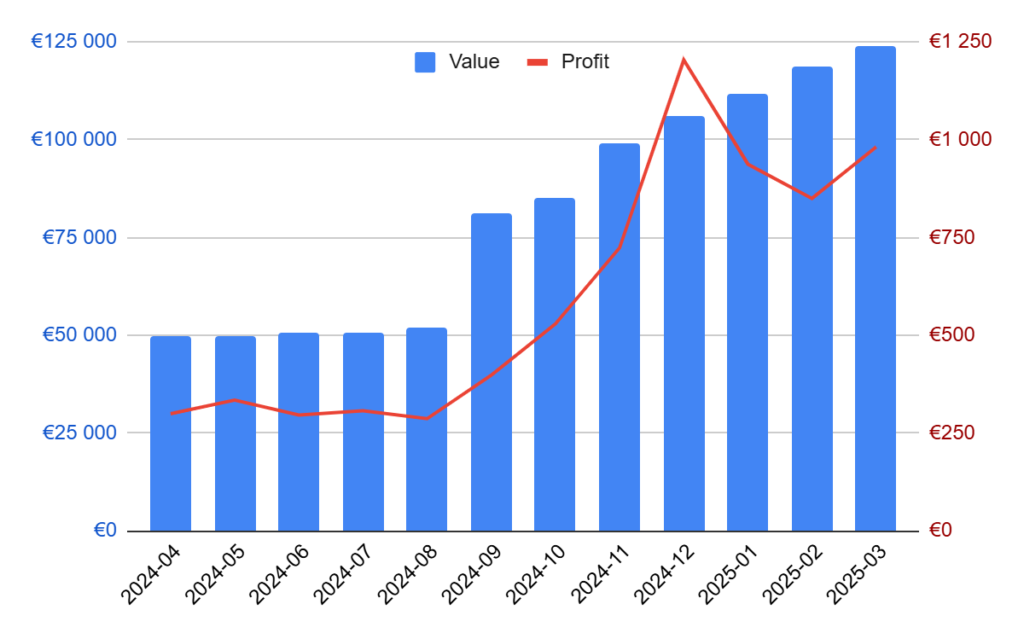

Portfolio history (last 12 months)

Portfolio summary

| Position | Value | Profit |

|---|---|---|

| Bitfinex Lending | €4 578 | €25 |

| Mintos (EUR) | €43 618 | €456 |

| Mintos (RUB) | €2 989 | €0 |

| Robocash | €21 117 | €183 |

| Esketit | €14 010 | €99 |

| PeerBerry | €19 584 | €118 |

| Income | €7 532 | €52 |

| Debitum | €4 271 | €48 |

| ETF | €6 304 | -€239** |

| Total | €124 005 | €981*** |

(***) Due to the lack of certainty of the exchange position, the ETF was excluded from the total profit.

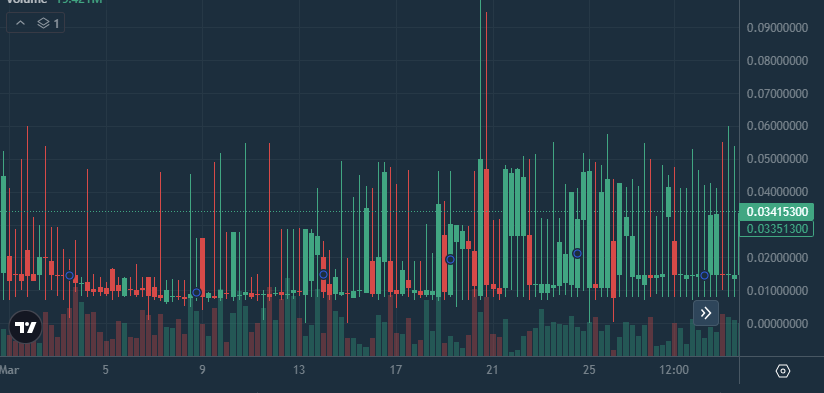

Bitfinex Lending*

As a reminder, in mid-January I changed my strategy to lending with an interest rate of 0.02% per day. Although the growth is better than in recent months, the percentage is still unsatisfactory, i.e. below 10%. The position requires further monitoring

Graph of all loans sold in the last month:

Mintos (Euro €)*

The largest position in the portfolio is characterized by stable growth. A large part of the outstanding positions was returned, which translated into a monthly return result exceeding 12% y/y. I continue to steadily increase the position, trying to diversify the lenders.

A small update from Mintos: a new user interface has been implemented that better aggregates the different investment options (loans, bonds, real estate, etc.). Unfortunately, this will change the format of the screenshots I post on the blog.

👉 If you want to start your adventure with Mintos platform, please check out my review: Mintos Review (2024): 14.89% return after 3+ years

Signing up using my invitation link, you will receive €50 for investing €1,000+ and a 1% bonus on the amount invested within the first 90 days.

Mintos (RUB ₽)*

As a reminder, since the war in Ukraine , the position is in the process of being paid out . Currently, the last company to be paid out is Kviku. Mintos announced in March that an agreement was signed to sell the arrears to a third party. All necessary permits are currently being collected.

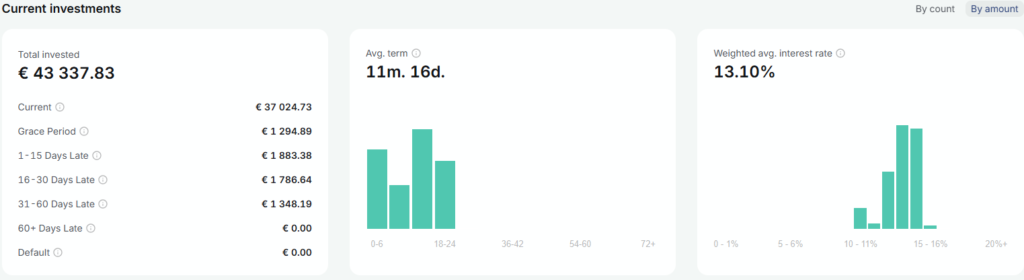

Robocash*

The value of outstanding positions exceeded 1000 euros for the first time. I hope that this is just a temporary incident. At the same time, the position returned to a more stable track with an interest rate above 10%, and the value of uninvested money fell to 300 euros.

👉 If you don’t know how to start your adventure with Robocash. Feel free to check review and detailed description of my strategy: Robocash Review (2024): 12.65% return after 2 years

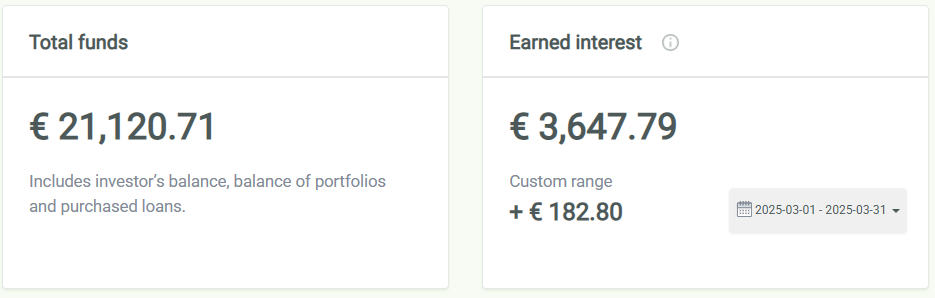

Esketit*

Despite the lack of cash lag at the end of the month, I can’t say that it was like that throughout March. Unfortunately, the position is far from maintenance-free. It requires constant monitoring of whether cash is in lag, and you have to look for items on the secondary market . The positive thing is that you can find items sold without additional fees.

Due to the sudden cash outages, the returns dropped to 8%. It is worth noting that the return calculated on the platform is 11.8%. Unfortunately, it is based only on the money invested.

👉 By registering using my invitation link, you will receive a 1% bonus on the amount invested within the first 30 days.

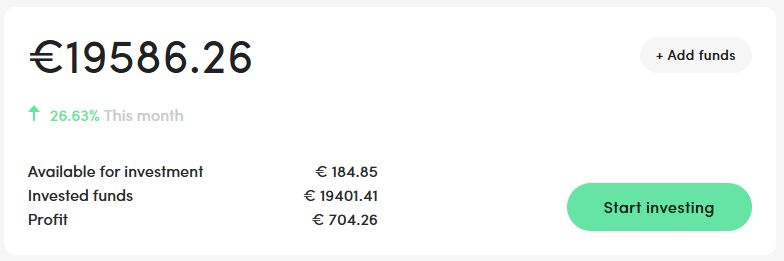

PeerBerry*

Similar to Esketit, this platform also requires constant monitoring of uninvested money. Although I have developed a mechanism that automatically invests in new positions, it requires manual activation when necessary.

Nevertheless, the stability of the position, the history on the market plus the value of unpaid positions made me decide to take on the task of exceeding the next loyalty bonus threshold , i.e. EUR 25k. Which should translate into +0.75% bonus.

We start in small steps with an investment of €4,000 in March 😉

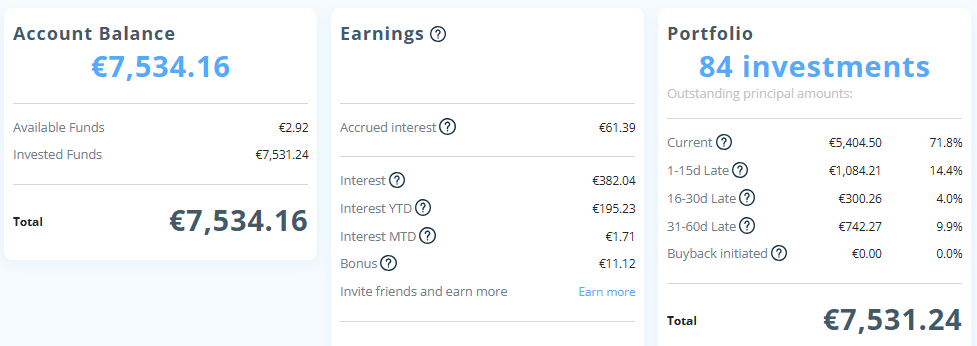

Income*

New on the platform, Income has signed an agreement with a new intermediary Virtus Lending, providing leasing and consumer loans in Kosovo. Virtus Lending’s distinctive feature is the fully automated loan process – some applications are approved in just one minute.

For investors, loans are available with an annual return of 10-12%. All loans are covered by a buyback guarantee and, additionally, leasing loans are partially secured by the vehicle.

The month of March brought an exceptionally low result, due to a large cash outage . Practically until the middle of the month, 1/4 of the portfolio was available. Only the inclusion of a new lender in the strategy solved the problem. I hope that this will be a permanent solution.

Debitum*

Debitum launched new promotional campains, one of them was a typical cashback, the other was based on a reward system depending on the size of new deposits.

I understand the high need for new investors with a lot of availability of good interest bearing positions. In my opinion, endless promotions are not a good motivator for existing investors. They discourage me from investing in a position in Debitum .

It is difficult to get the impression of a lot of pressure, not to say desperation to raise new money. Unfortunately, trust in the platform cannot be built by shortcuts , and it certainly cannot be built by promotions. It takes time and, unfortunately, crises when problems occur with borrowers or intermediaries.

By the way, I have already stumbled upon the injustice of such campaigns several times. It is enough to invest a day before the cashback campaign and, ping, you have just lost additional income . There would be no problem if such campaigns were sporadic, unfortunately, a new campaign is launched every month.

At the same time, I have the impression that constant promotions have had a negative impact on the interest rates offered in new positions. For example, 3 months ago, annual Juno Sandbox funding positions were offered for 12+%, now it’s only 10.5%. I would prefer a higher interest rate in exchange for the lack of cashback campaigns.

ETF

Position currently in the observation and waiting phase, with no plans for changes in the coming months.

(*) I play open cards. Links marked with an asterisk are affiliate links. If you use them, I will receive a commission. It won’t cost you anything, and often you will get a bonus too – More information can be found on the pages under the specific links.

(**) Due to the nature of the stock market, income should be understood as potential until the position is realized.