Portfolio update – August 2023

How to achieve financial freedom?It’s easy to say. It’s harder to achieve. For the future me is this journal entry. Starting from the year 2021, I describe the long way, point out the successes and the wrong decisions that I have made. I hope it will also motivate you to build your financial independence.

Summary

The last month of vacation, was quite lazily. There were no major turbulences, with returns staying around the average level of €300.

To shake up this boring month a bit, I increased my Robocash position by an additional €3000. For details regarding this decision, please see below.

Portfolio history (last 12 months)

Portfolio summary

| Position | Value | Profit |

| Bitfinex Lending | €10 221 | €118 |

| Mintos (EUR) | €12 854 | €148 |

| Mintos (RUB) | €2 655 | €2 |

| Robocash | €10 820 | €80 |

| ETF | €2 682 | -€50** |

| Total | €39 232 | €298 |

Bitfinex Lending*

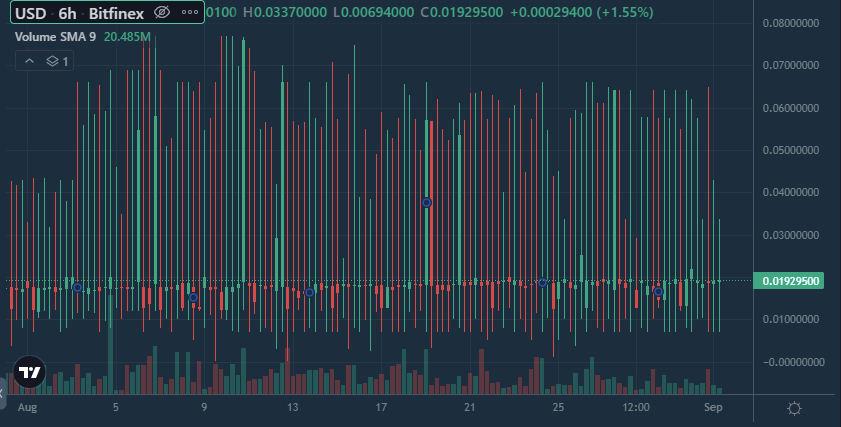

The first full month of the new strategy. The situation on the loan market was very stable (as seen in the chart below). The lack of major fluctuations makes it easy to determine the standard monthly return. It should stabilize at 13-14%.

Which is still a better result than loans from P2P platforms, not to mention the rates of deposits in EU.

Below is a chart of completed offers from the last month:

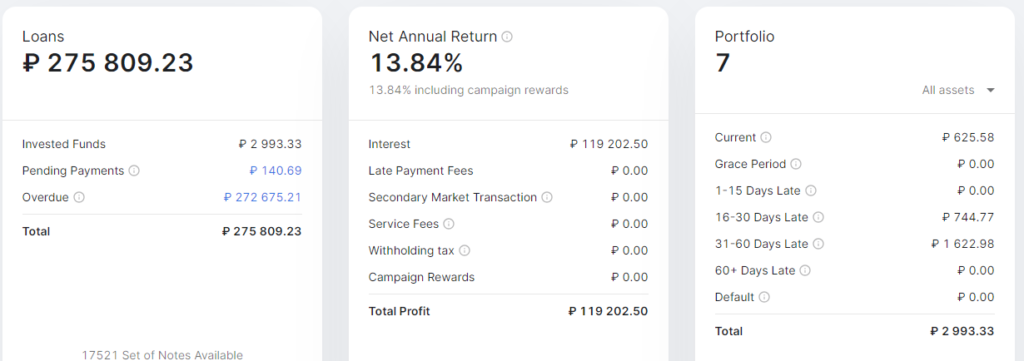

Mintos (Euro €)*

Another stable month at Mintos, no major changes in profits. The residual deposit is the result of automatic conversion of completed ruble positions.

Late loan repayments began to increase again. I hope this is just a temporary trend.

Mintos (Rubel rosyjski ₽)*

The position is in the middle of a payout. The wallet is almost entirely made up of loans from Kviku. Unfortunately, this money is still frozen since the war in Ukraine. Currently, it is in the process of legal proceedings conducted by Mintos.

If you are interested, please visit the Mintos blog where you can follow the ruble thread.

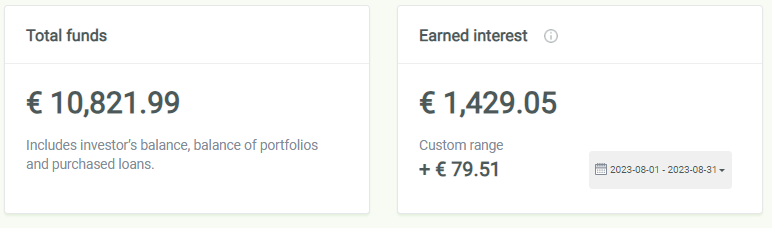

Robocash*

Ostatnie zmiany w systemie bonusowym mogły w pierwszej kolejności odstraszyć inwestorów. W mojej ocenie świadczą o stabilnej pozycji, jaką wypracował sobie Robocash. Są sygnałem, że Robocash nie ma już potrzeby budowania bazy kapitałowej.

Recent changes to the bonus system may scare off investors in the first place. But in my opinion, they prove the stable position that Robocash has achieved in the market. IMO it is a signal that Robocash no longer needs to build a capital base.

For this reason, this month I increased my portfolio position by almost 50% by depositing EUR 3,000.

As a reminder, I am posting a new table of bonus interest rates depending on the capital:

If I wanted to reach the first bonus threshold, I would have to double my wallet. I do not plan such moves in the next year.

ETF

Investing in ETFs is still in the fun/testing phase. For now, he does not plan any major changes in this position.

(*) I play open cards. Links marked with an asterisk are affiliate links. If you use them, I will receive a commission. It won’t cost you anything, and often you will get a bonus too – More information can be found on the pages under the specific links.

(**) Due to the nature of the stock market, income should be understood as potential until the position is realized.