Portfolio update – December 2023

How to achieve financial freedom?It’s easy to say. It’s harder to achieve. For the future me is this journal entry. Starting from the year 2021, I describe the long way, point out the successes and the wrong decisions that I have made. I hope it will also motivate you to build your financial independence.

Summary

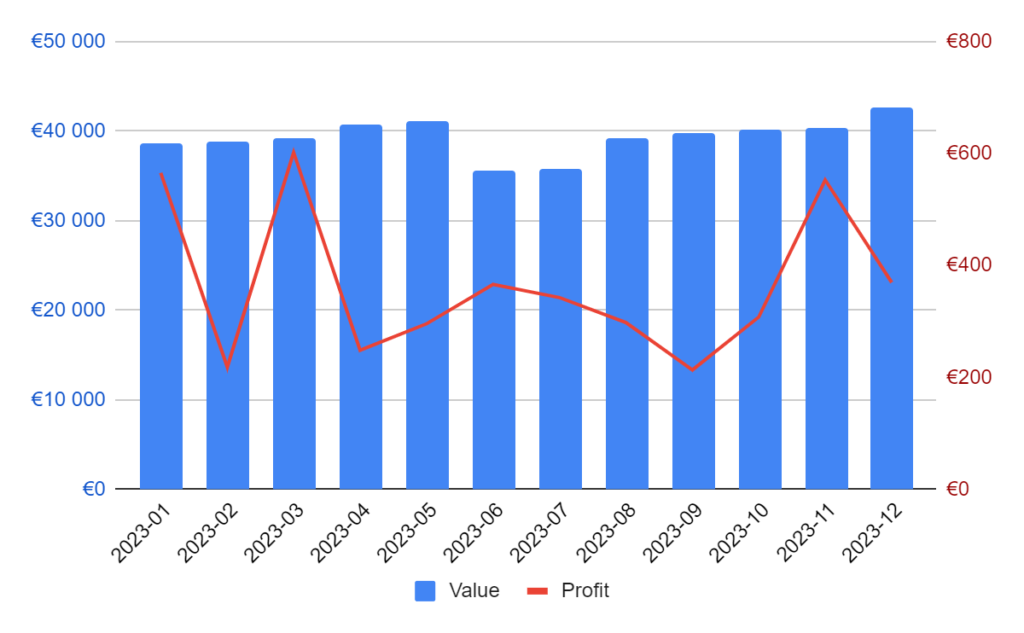

Last month was characterized by an extraordinary turnaround. However, nothing lasts forever, so this month I am experiencing a decrease. After deducting ETFs, the income in December comes out to 270 EUR.

Among other noticeable changes. After over 17 months, I am adding a new item to the portfolio. After ETFs tests, I find out that P2P lending is much more predictable. The biggest challenge is to choose an appropriate and reliable platform. And there are dozens of platforms on the market. By doing a quick research on the most stable platforms, I built a shortlist. Then I analyzed each item in detail. Platforms included in the analysis:

Portfolio history (last 12 months)

Portfolio summary

| Position | Value | Profit |

|---|---|---|

| Bitfinex Lending | €10 502 | €57 |

| Mintos (EUR) | €13 424 | €111 |

| Mintos (RUB) | €2 756 | €0 |

| Robocash | €11 151 | €94 |

| Esketit | €2 011 | €11 |

| ETF | €2 787 | €96** |

| Total | €42 632 | €370 |

Bitfinex Lending*

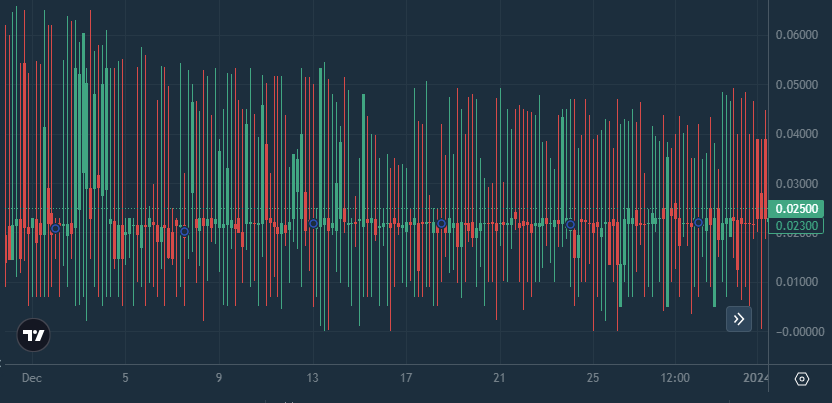

The month was bearish, as you can see in the chart below. My loan issuance mechanism has behaved unstable in such a trend. As a result, the system recorded a significant drop in returns (from 15% to 6%). I have implemented additional modifications to the mechanism, the results will be available in the next month.

Chart of all loans from the last month:

Mintos (Euro €)*

In December, I managed to purchase loans with an interest rate of 15% on the secondary market for a small commission. Unfortunately, this commission reduced the return in December. However, if all goes well, it will be possible to make up for it in the coming months.

Mintos (Rubel rosyjski ₽)*

Position in the withdrawal process. This position has reached the point where all assets stay in one company – Kviku, for almost 2 years. This puts me in front of a difficult decision, what to do with this position. Keeping it in your wallet and waiting for the withdrawal seems naive and unnecessarily occupies my head in monthly updates. On the other hand, Mintos is actively working to resolve this situation in the legal field.

Robocash*

In the previous summary, I mentioned the reduction in the loans % in the Robocash strategy, and that it will affect the income in the upcoming months. After all, previous “high-interest” loans must be repaid.

It turns out that this happened much faster than I expected. Loans were paid off ahead of schedule. Currently, over half of the portfolio is on loans with the lowest interest rates (10%). You may see the result of that in the December profit.

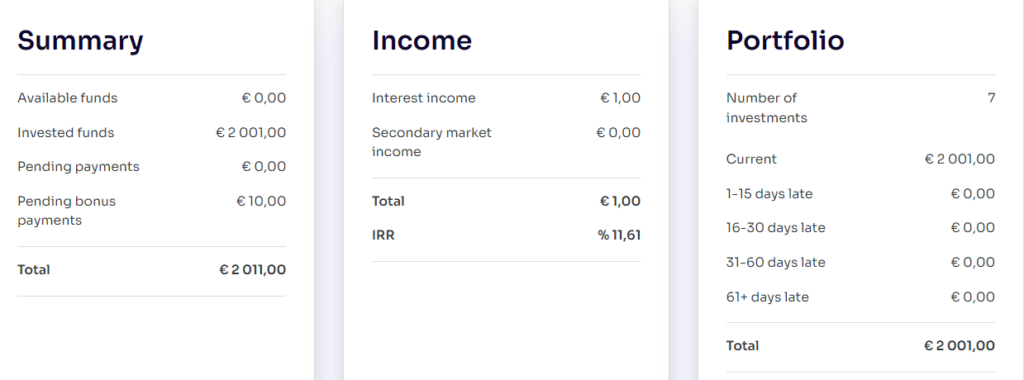

Esketit*

New item added to the portfolio. To start with, a deposit of amount EUR 2,000. The first profits from loans were realized in December. Position will be observed over the next months. Especially in terms of delays and availability of loans.

Currently, loans in the portfolio have interest rates in the range of 11-12%.

ETF

December’s position results look very promising. After a year and a half, the total profit is around 20%. Is it much or little? It’s hard to evaluate, especially as the efts in which I invest belong to the group of developed economies. They are characterized by the least variability over time and the greatest stability.

It is said that ETFs are the best long-term investment for beginners. However, I still have doubts every time I have to increase this part of my portfolio. Is this the time to buy? Isn’t that a top? Or maybe this is just the beginning of growth? Or maybe I should not worry about it at all and buy blindly?

This uncertainty makes that I prefer investing in P2P lending. Maybe I need to grow up to it as an investor? 😉

(*) I play open cards. Links marked with an asterisk are affiliate links. If you use them, I will receive a commission. It won’t cost you anything, and often you will get a bonus too – More information can be found on the pages under the specific links.

(**) Due to the nature of the stock market, income should be understood as potential until the position is realized.