Portfolio update – March 2024

How to achieve financial freedom?It’s easy to say. It’s harder to achieve. For the future me is this journal entry. Starting from the year 2021, I describe the long way, point out the successes and the wrong decisions that I have made. I hope it will also motivate you to build your financial independence.

Summary

This will be a longer entry. On the one hand, Mintos has launched a financial round, on the other, it’s time to show off the new item in your portfolio. A few months ago I added Esketit to my portfolio, this month I’m adding PeerBerry to it. I write about the reasons for this decision below.

The update appeared a little bit later than usual due to waiting for the launch of the crowdfunding round for Mintos. More about it in the Mintos section.

But for now, please check out the update:

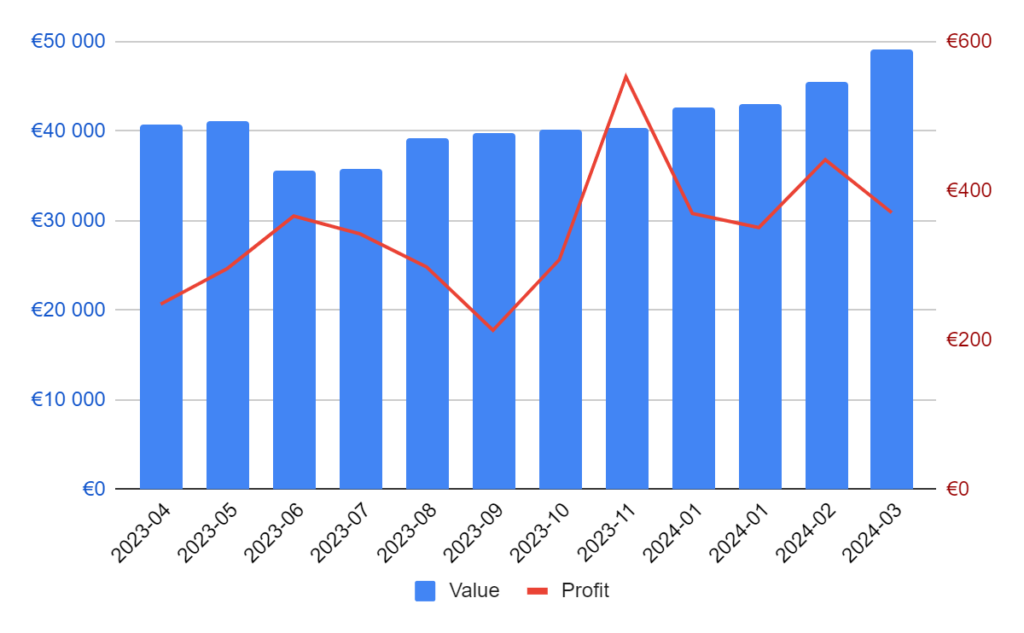

Portfolio history (last 12 months)

Portfolio summary

| Position | Value | Profit |

|---|---|---|

| Bitfinex Lending | €10 888 | €39 |

| Mintos (EUR) | €13 837 | €130 |

| Mintos (RUB) | €2 730 | €0 |

| Robocash | €11 425 | €91 |

| Esketit | €4 194 | €56 |

| PeerBerry | €3 008 | €8 |

| ETF | €3 063 | €47** |

| Total | €49 145 | €371 |

Bitfinex Lending*

Low demand in the Bitfinex lending market affected the result. The minimum interest rate on the loans I take is 0.04% of the daily return. The chart below shows that prices were below this level for most of the month. If this trend will continue for the next months, I am considering lower the minimum entry level or even partial exit from Bitfinex. There is no point in keeping your money where it is working on such low results.

Graph of all loans last month:

Mintos (Euro €)*

Let’s start with this month’s hot potato, the Mintos investment round. Without delving deeply into the financial analysis, I will present my arguments that made me decide not to invest in this round:

- Every financing round, whether in venture capital or crowdfunding, should have a business plan with information on what the new funds will be used for. There is no such document here. There is a simple statement about expansion into new markets – I contacted Mintos, unfortunately, due to the public nature of the round and the competition around, they do not want to share their expansion plans. In my opinion, the campaign is aimed at platform enthusiasts rather than professional investors.

- Investing in a company with no exit option for 5 years vs. investing on the Mintos platform with the possibility of a quick return of 12%+/year and exit at any time. For me, the second option wins in this competition.

- Not everyone remembers, but this is the second social round of Mintos. The previous one was in 2020 and ended with financing of €6.5m (in the current one €3m has been collected). Although Mintos has valued itself at more than 2x as much, previous investors have no way to exit this investment. The second round could be a good opotunity to cash out those who want to exit. What’s even more interesting is that in the discussion section of the previous round, people are offering shares cheaper than they are offered in the current round (up to 20%). Unfortunately those information are completely ignored by CrowdCube and Mintos.

To sum up, I will not participate in this round.

I highly recommend that anyone interested enter the discussion module on the CrowdCube platform, both the current and the previous round. Very interesting topics are discussed. For example, the prospects for a return in 2026 present the level of €600k, while Mintos itself is already valued at €120m. Which corresponds to the return on company value for over a 160-years.

Anyway, if anyone wants to invest, here is a link to the round. The round result is not impressive compared to 2020 (3m vs 6m), but there are still 10 days until the end of the campaign.

Let’s get back to the monthly summary, there was a slight increase in the value of outstanding loans. Despite everything, the profit was almost identical to February.

If you want to start your adventure with Mintos platform, please check out my review: Mintos Review (2024): 14.89% return after 3+ years

Mintos (Rubel rosyjski ₽)*

Reminder, since the war in Ukraine, the position is in withdrawal progress. Currently, there is the last company left to repay – Kviku.

Nothing new, but I would like to remind you that Mintos announced next steps in the confrontation with Kviku and plans to sell its debt to an external company. What the return is currently unknown.

Robocash*

Robocash is stable as always, and this time it managed to repay most of the delayed loans. Unfortunately, the large money supply means that loans have extremely low interest rates (around 10%). However, they are still higher than the rates offered on savings accounts.

If you don’t know how to start your adventure with Robocash. Feel free to check review and detailed description of my strategy: Robocash Review (2024): 12.65% return after 2 years

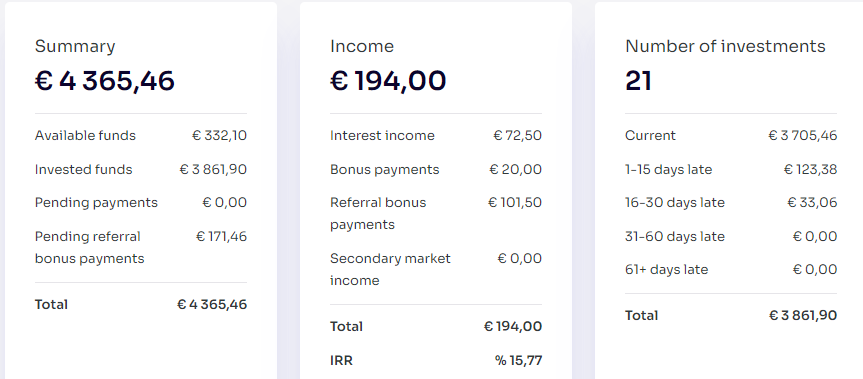

Esketit*

After doubling the portfolio value last month, it was time to harvest profit. I admit that the result exceeded my expectations, almost 16% 🚀. This result was additionally achieved by repaying most of the outstanding loans and receiving the second tranche of the starting bonus (€10).

Nice, although I know the result is temporary. Nevertheless, it is pleasing to see that the new investment is working.

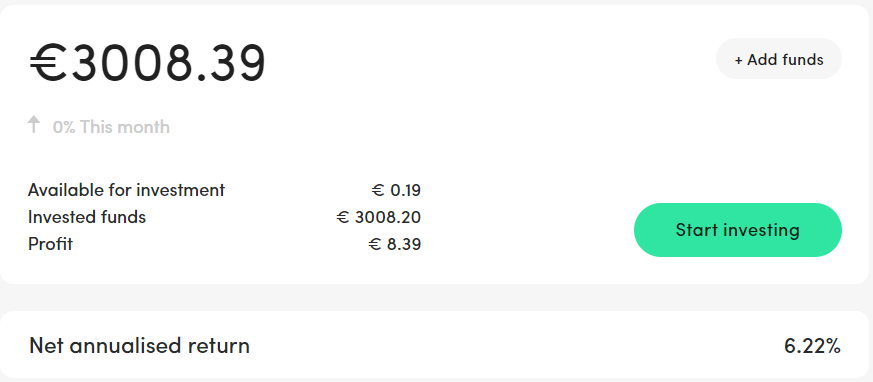

PeerBerry*

And here we are, it’s the moment for a new egg in the investment basket. It’s high time to show it off. A company with a long history in the world of P2P loans, on the market since 2017. With the size of the entire portfolio at the level of EUR 101 million. Five times smaller than leader Mintos, but still mothe than twice as Esketit. But it’s not time to review the platform yet. We will wait with it until stable returns last several months.

I have been keeping the investment in my portfolio since December, just like Esketit. Since then, I have been closely observing the algorithms that control the platform. The first observation is visible when you try to invest – there are no loans on offer, or they only have a low interest rate (9%). But this does not mean that there are no higher ones, but they need to be “catched” using the automatic investment mechanism. Thanks to the discovery of this approach, my current portfolio has an average return of 11%.

PeerBerry is a mix of the Robocash platform (with lender companies belonging to its own capital group) and Mintos (where independent companies offering loans). At the moment, I have configured my strategy to invest only in loans secured by group guarantees. Without paying much attention to the countries where loans are offered.

The distribution of countries itself has skyrocketed in Kazakhstan, so automatic diversification between countries is certainly not the strong point of the platform, not to say that it simply does not exist.

ETF

Another ATH broken in March. No further deposits, probably until some major reduction in value occurs. Sometimes I wonder if it’s not a good time to cash in my position and move it to P2P.

(*) I play open cards. Links marked with an asterisk are affiliate links. If you use them, I will receive a commission. It won’t cost you anything, and often you will get a bonus too – More information can be found on the pages under the specific links.

(**) Due to the nature of the stock market, income should be understood as potential until the position is realized.